Specific Objectives:

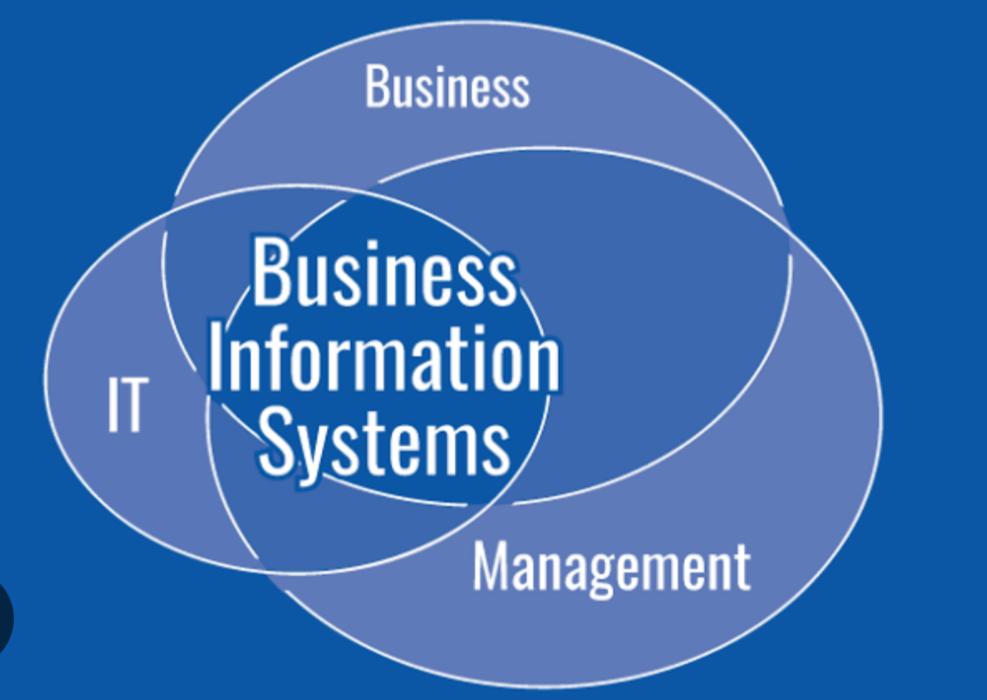

1. To impart a general awareness on MIS

2. To learn types of MIS

3. To understand DBMS and types and models

4. To study ERP, benefits and drawbacks

5. To familiarise with Business Process Reengineering and merits and demerits

Specific Outcomes:

1. Knowledge of MIS helps to gather, process and take decisions easily.

2. It helps to provide right information at the right time at the right quantity

3. Knowledge of DBMS helps to process data scientifically keeping all manifestations.

4. Understanding of ERP helps easy automation and results in reduced costs.

5. Business Process Reengineering results in increased dignity in business and profits

- Teacher: JYOTHI M V VV College

Specific Objectives:

1. To examine various types of types of network – to evaluate the computer application in LAN, VAN and similar other networks.

2. To equip the students with the theoretical and practical knowledge in developing website and to understand the basic structure of HTML

3. To enable the student to develop websites for the business and equip them in modern technology relevant for the business survival.

4. To equip the student with various ecommerce platforms and enable them to evaluate the various pros and cons of digital payments

5. To keep the students learnt the threats associated with Computers and Internet and to learn the legislative background and support available.

Specific Outcomes:

1. Knowledge of networking and its application business helps students to learn in a networked community much easily.

2. Knowledge of website creation and its updation and maintenance magnifies the identity and scope of business at much cheaper a cost.

3. This helps to grow business across boarders easily.

4. Students become more competitive in this digital era for he knows these entire well.

Knowledge of the threats present in the Net helps to take preventive measures early and thereby could be avoided on time.

Specific Objectives:

1. To give an overview of Management Accounting

2. To study the methods of analysing financial statements

3. To learn Ratio analysis

4. To learn Fund Flow and Cash Flow analysis

5. To understand CVP analysis

Specific Outcomes:

1. To make the learner aware of the methodologies of Management Accounting

2. It is to make the candidate learn how to conceive and interpret financial statements

3. Ratios are very helpful tools for analysis and interpretations.

4. Knowledge of movements in working capital helps to check/control flow of funds/cash.

Knowledge of CVP analysis will be of great help for managerial decision making.- Teacher: SUNU K T VV College

Specific Objectives:

1. To impart a general idea of research and types of research.

2. To study the fundamentals of research and measurement of reliability

3. To learn scientific data collection process

4. To understand scientific data processing techniques and testing of hypothesis

5. To study drafting of a research report and matters to be kept in mind.

Specific Outcomes:

1. The learner knows the primary matters of business research

2. The student know how to fix a research design, scaling checking validity etc

3. The candidate knows the method of data collection and its processing and validation.

4. The learner knows to process collected data, test hypothesis and arrive at conclusions

5. The student knows well how to write an academic report and present it

- Teacher: SWAPNA C S VV College

Specific Objectives:

□ To learn taxation system in India, and to learn taxable income, exempted income, agricultural income, calculation of taxable income, residential status etc.

□ To learn computation of taxable income under the head Salaries.

□ To understand taxation of income under the head House Property.

□ To study calculation of taxable profits and gains of business or profession.

□ To seek provisions of taxing capital gains and other sources

Specific Outcomes:

1. To understand the method and methodology of taxation on income in India.

2. To learn the provisions related to computation of Taxable Salary Income.

3. Knowledge of taxing income from house property helps the learner to compute taxable income under the head House Property correctly.

4. Knowledge of computing income under the head profits and gains of business or profession helps the learner to do it effectively in life.

5. Knowledge of computing income under the head Capital Gains and other sources makes the learner self-confident and competent to practice income tax.

- Teacher: Priya K VV College

- Teacher: SHEEJA V V VV College